First Time Homebuyer Resources

Your First Home is a Big Deal. Buying your first home is monumental. It’s a huge financial investment and a major life milestone. Unfortunately, nowadays it’s more difficult than ever to make the purchase by yourself. Luckily, in a market as diverse and ever-evolving as ours, there are many resources available for first-time homebuyers. […]

What is The Hype Around Ottawa’s Boom Towns

What is The Hype Around Ottawa’s Boom Towns: Why “Rural” Ottawa Continues to Grow While we have seen an increase in home prices steady across the province over the last two years, rural outlier communities like Carleton Place, Arnprior and Kemptville have seen unprecedented growth and attention, handing them over “Boom Town” status. These Ottawa area […]

Real Estate Forecast 2022 – Why Ottawa Remains a Top Choice For Homeowners

Real estate in Ottawa is so great for so many reasons. Not only is the capital city a beautiful one filled with breathtaking scenery, extraordinary views, lively green space, and the ravishing Rideau River, it also is one of the most affordable major cities in the country, with a little something for everyone. Whether you […]

Beyond the Sign: The current market shift

After an intense few years, the local real estate market is showing a very slight shift towards calmer waters. Jason Ralph, Broker of Record and President of Royal LePage Team Realty, explains, “The market was so overheated that even a small shift seems drastic, even though it isn’t going back to pre-2020 levels. We are starting […]

Mortgage Shopping: What Does a Mortgage Broker Do?

In what has been an unprecedented year in buying and selling, Ottawa Real Estate is remaining hot, and mortgage rates cool. While buying a home and getting a mortgage is a big financial decision, the process of securing a loan leaves even the most experienced buyers with a laundry list of questions. Naturally, you will […]

Royal LePage TEAM REALTY Tip Series: 6 Tips For Buying Rural in Ottawa

While buying rural has its advantages, if you have never purchased rural property or lived in remote areas, knowing what to look for may make you feel a little lost. To make sure this process goes smoothly, we have compiled a list of tips to consider when making your purchase so that you can fully …

Royal LePage TEAM REALTY Tip Series: 6 Tips For Buying Rural in Ottawa Read More »

How COVID-19 changed the face of Real Estate in Ottawa

Real Estate in Ottawa has been a hot topic for some time now. Despite the industry’s sudden shutdown at the beginning of the pandemic, home sales picked up as soon as it was announced that the Real Estate industry was deemed an essential service. Since then, Ottawa residents have been fascinated as they watch homes …

How COVID-19 changed the face of Real Estate in Ottawa Read More »

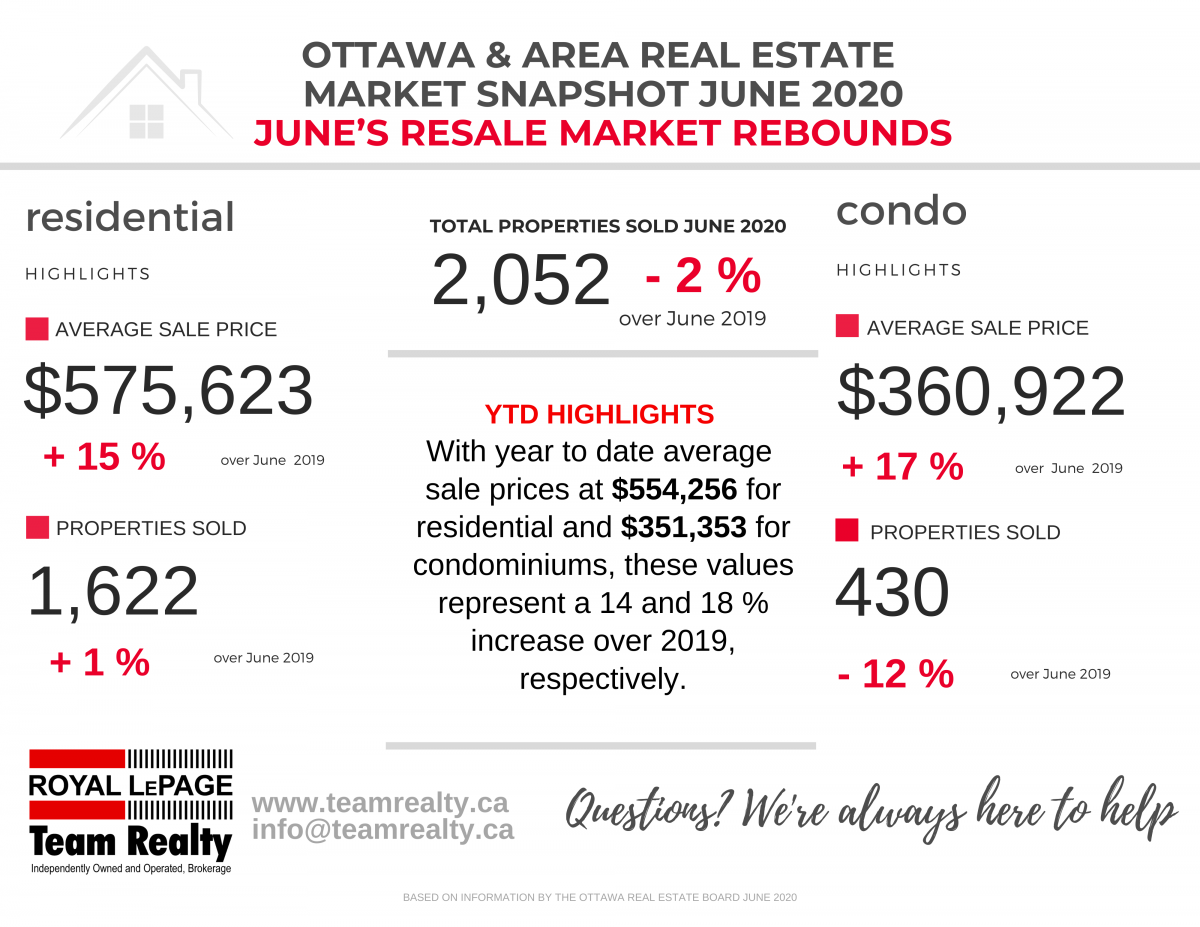

Ottawa Real Estate Snapshot June 2020: June Statistics are a Welcome Sign of Things Getting Back on Track in our Marketplace

Market Snapshot: A dramatic upswing in the number of sales this past month with sales within 2% of this time last year! While it didn’t come as a surprise that unit sales were down 55% in April, and 44% in May, in dramatic contrast the June figures are a welcome sign of things getting back …

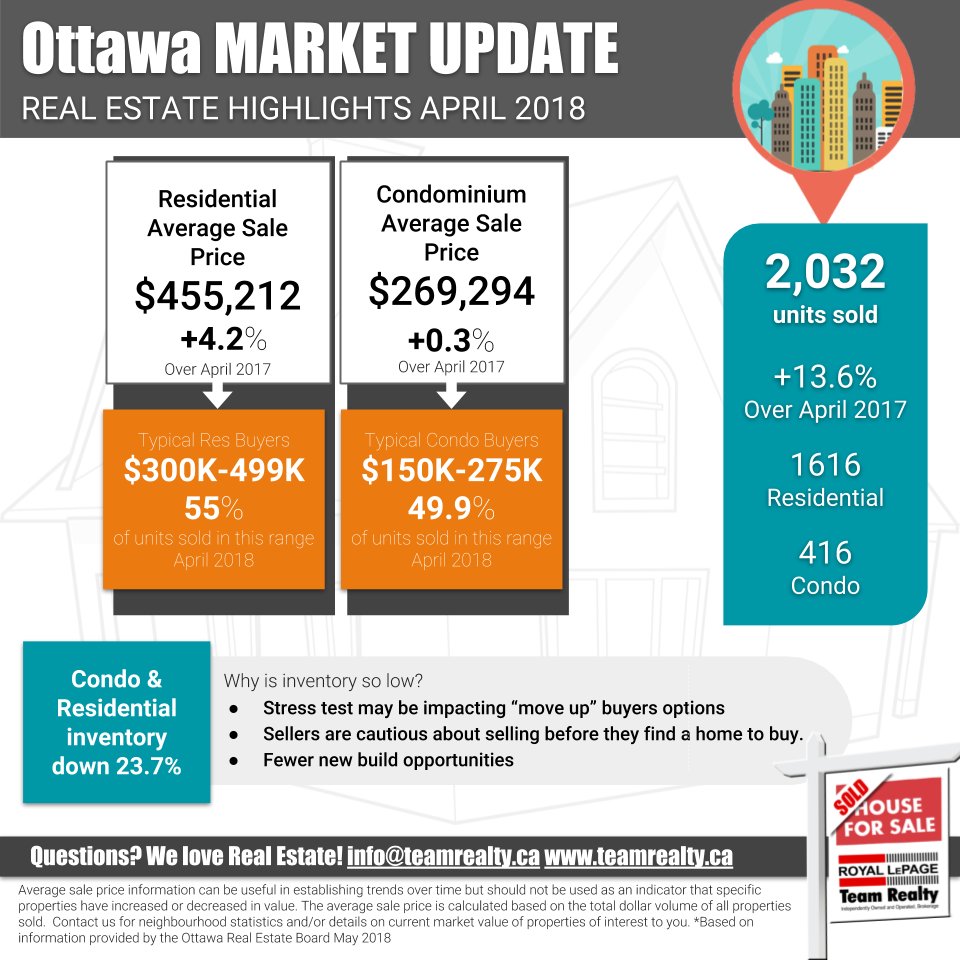

Hot Real Estate Market in an Icy April

The Spring market continues to buzz in Ottawa real estate, with the number of sales up over 13% in April in spite of inventory levels being down 23% over this time last year. Home buyers are seeing more competition, which is good news for sellers. Certainly we are seeing more multiple offers and higher sale […]

What Home Buyers Should be Looking for When Viewing a Property

You’ve done your research, found the perfect Realtor, crunched the numbers, created your list of must-haves and now it’s time to start the exciting process of HOUSE HUNTING! When you’re looking at homes for sale it isn’t always easy to look beyond the cosmetics. Not to worry, we’ve created this handy graphic to help home […]